The Ultimate Guide to Keeping Vehicle Logbooks

If you’re an employer who provides vehicles to your employees for work purposes, you may need to keep track of their usage to comply with Fringe Benefits Tax (FBT) regulations. This can be a daunting task, but it can be manageable with the right knowledge and tools. In this guide, we’ll cover everything you need […]

Inventory Accounting – Is it Important?

Inventory Accounting is keeping track of your inventory, the time it takes to sell, and the profit made on each product. It is essential to track inventory if you want to manage your business effectively. What counts as inventory? Inventory is anything you buy to on-sell, including fully-completed items to sell in your store, products […]

Budgets Are Boring! 5 ways to spend less without one.

If you hate budgets and budgeting and find it sooo boring, how can you easily cut your spending? Here are five ways to save without tracking every transaction: Confession Time… We Love Budgets! We actually love budgets, even though they have a boring reputation. They’re part of the spreadsheet family, and you know that spreadsheets […]

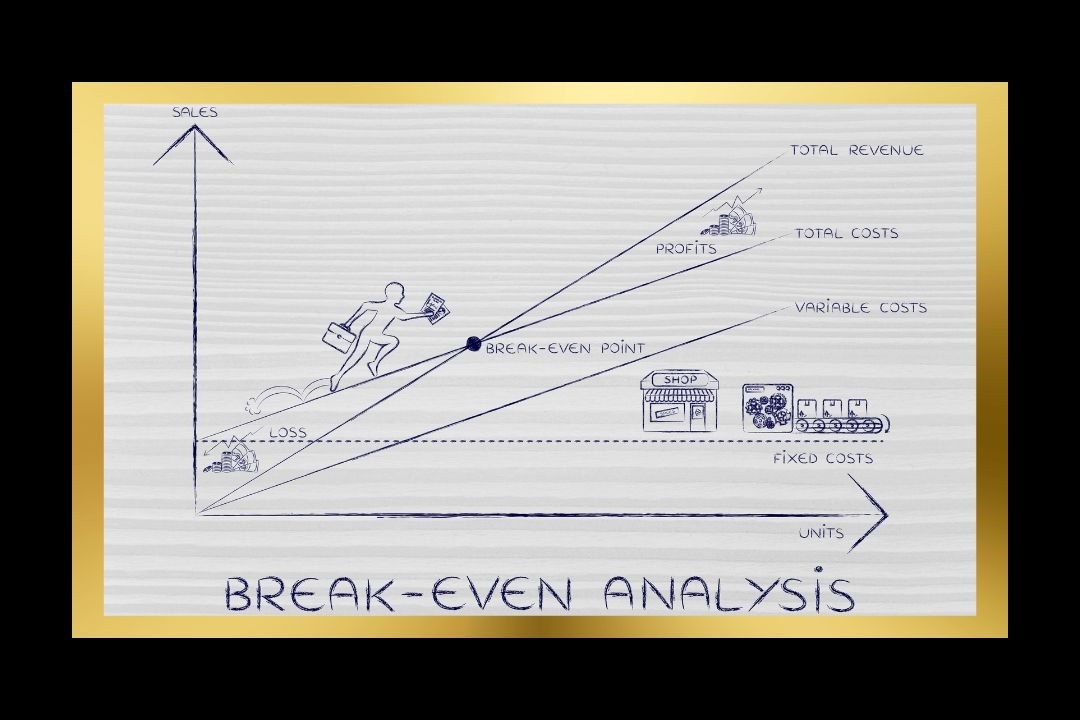

Breakeven Point – What’s Yours?

Understanding your business breakeven point is essential to know how much money you need to make to stay in business. It can therefore help you make well-informed financial decisions and practical business plans. The breakeven point is the income or sales needed to cover all costs. Any earnings above this point generate profit. So your […]

NEW RULES: Working From Home Deductions

Starting in the 2022-2023 financial year, there are new rules for keeping records and calculating deductions for people who are working from home. There are now two ways to work out your deductions: the actual cost method and the revised fixed rate method. The revised fixed rate method has been changed to make it easier […]

Cashing Out Annual Leave – Here’s the lowdown.

Are your staff asking about cashing out annual leave? There are some important rules to remember before paying out annual leave. Firstly, you must review the employee’s modern award to check that cashing out leave is explicitly allowed. Most awards allow for excess annual leave to be paid out, and we give you the general […]

Business Tips: Go Digital and Cloud

Transforming into a digital and cloud business sets the best possible infrastructure for future growth. And, as your business scales, the benefits of going digital will become apparent. Running your key business processes in the cloud and using the latest digital software and apps adds to your efficiency and productivity. And most importantly, digital systems […]